Written by Guest Contributor on The Prepper Journal.

Editors Note: An article from Andrea Crandell to The Prepper Journal. If you have information for Preppers that you would like to share then enter into the Prepper Writing Contest with a chance to win one of three Amazon Gift Cards with the top prize being a $300 card to purchase your own prepping supplies!

As preppers we take that extra step to be physically secure in our lives, to be prepared as possible for things like last weeks hurricane, other natural disasters, political upheaval and even governments constant infringement on our rights in the name of a false sense of security. We plan for the worse and hope for the best. In doing such there is an area of planning that is just as valuable as the physical things we seem to focus all of our attention on, and that is the fiscal/financial side of life. Learning early how to manage you money is invaluable. No matter if you are a tradesman or a doctor, managing money is a required life skill in order to survive.

Personal Finance Skills You Should Learn While You’re Young

Money shouldn’t really be something that you’re thinking too much about when you’re still a teenager or a college student. However, once you find yourself looking for employment in the real world, then it’s time to really start thinking about how you’re going to handle your finances going forward.

Things could get very messy for you if you don’t take charge of your money as soon as you start earning it. A lot of young people are sadly not that familiar with the financial world. So if you educate yourself on these things as early as possible, you could save yourself an awful lot of hassle long-term.

Here’s five personal finance skills that you can get a handle on early that will help you your entire life.

Budgeting

This is probably the most important skill for anyone who’s about to start earning money and is unfortunately something that a lot of people think is unnecessary. What you should do when setting up a budget for yourself, is make sure that you are as thorough and as detailed as possible. Make sure that you factor in all of the money that you’re earning, from every source of income, and where all of this money is going.

It’s not that hard to overspend on things. Sometimes stuff comes up that you weren’t expecting and you’ll often find yourself making decisions without thinking about the consequences. The first step is to make an extensive list of both your expenses and your income per month and then consider anything else that you are likely to spend on.

This of course includes having some money every month that you can spend at your leisure. Just make sure to practice self-discipline with this particular aspect of your budget. This is just a start, there’s a lot more to it. You also have to think about things like unexpected expenses which can and will come up for any of us. It would be well-worth downloading a budgeting app. There’s some great ones which can be very helpful in keeping track of what you’ve got planned for yourself. Sticking to a strict budget will ensure that you don’t make many stupid mistakes with your cash and will lay the foundation for financial stability.

Continuous Investments

If you want to get yourself into the best financial shape possible, you should definitely start taking out some investments. Once your budget is set out and you’ve made the decision to stick to it, you should take anything that is left over and find some stocks to invest in, or look into commodities or real estate. The idea behind this is that if you invest a small amount of money every month over a long period it will lead to some big returns in the future. But buyer beware, this is gambling in reality so it is best approached as a sterile analysis of what investments will grow and avoiding those that will not. Everyone who has ever invested in stocks or commodities has at least one horror story, if not several. Because you like Dreyer’s ice cream over Blue Bell ice cream is not always a good investment strategy. You need to be clinical in your decisions as opposed to emotional.

If you actually want to get these long-term returns, you have to know how to invest properly. There’s many wrong ways to do it that can backfire on you quite badly. You should do the research beforehand and find out which companies have a history of a good return-on-investment (ROI) for their investors. You should also see if you can find some companies that offer high yield dividends. These are good shares to invest in because they offer a share of the companies profits to the investors.

Once you’ve found the right shares and made the decision to invest, you also need to commit to actually investing every single month. Persistence is the key to value with investments. Do not panic when things look like they’re in a downturn and also don’t try to predict the ups and downs of the market yourself. Just put the effort in beforehand and then invest in the right places. It will be worth your while.

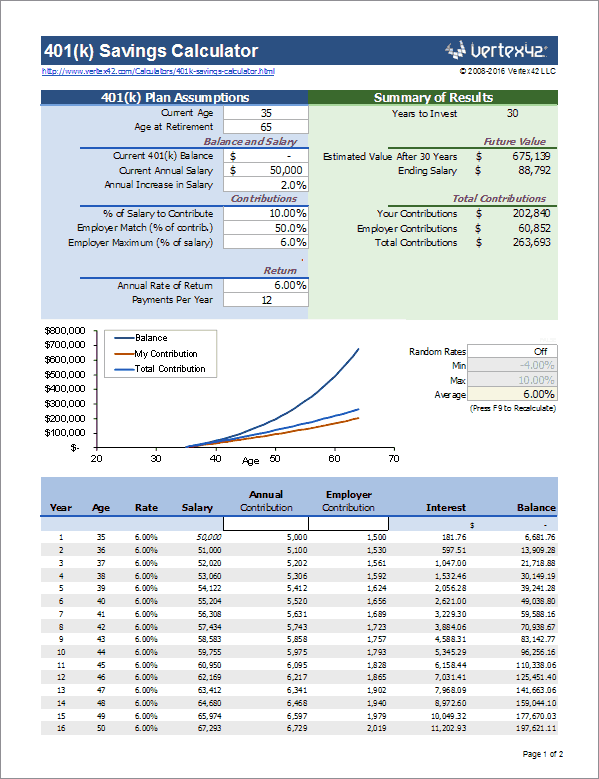

Planning for Retirement

It might seem to you like retirement is a lifetime away, and I guess technically it is, but it’s really never too early to start planning ahead. You should definitely start preparing for your financial state once your working life is over because the time will come eventually. If you start working towards this as soon as possible it will much easier for you and won’t take a huge chunk of your paycheck every month.

There’s a few different ways to do this. There’s something which you may have heard of before known as an Individual Retirement Account (IRA). How this works is straightforward. It’s essentially a savings account into which you put a portion of your monthly income. You can usually set this to work automatically so that the money will just come straight out of your paycheck before taxes or a bank account, after taxes have been taken, and you don’t have to worry too much about it. You can also use a system called 401(k) which is basically the same thing but will be sponsored by your employer. On pre-tax investments you will be taxed when the money is withdrawn at retirement, so you are betting that taxes in the future will be the same or less than they are now. Other forms of IRA’s (Roth) take the taxes now and you are not taxed when withdrawn in retirement. Do your homework here, it is important. There are limits to the portion of the investment you can make yearly.

Not every company offers this, and it would be a good idea to do a bit of research on the advantages and disadvantages of 401(k) before you make the decision to use it. No matter which method you choose, you should make this a top priority as soon as the money starts coming in. You’ll thank yourself for it later.

Negotiating

Negotiation is a very useful skill to learn but I don’t mean that you should use it for every single purchase that you make. There’s no need to negotiate over the price of milk in the supermarket or a shirt in a clothes store, but think about this for your major expenses.

When you’re buying a car or a house, you’ll often find that the seller is willing to give a little bit of wiggle room when it comes to the price. If you’re going to negotiate, make sure that you do it before you commit to buying anything and also make it clear to the seller that you are willing to walk if you can’t come to an agreement. If you’re selling something yourself, the same rules apply and you should use the same techniques.

Negotiation is also a great skill to have when you are being offered a job. Someone who has a handle on their finances always ensures that they get the best salary and benefits possible.

Refusing

Once you are actually earning your own money for the first time, the urge to spend it on whatever you want starts to creep in. You might think that this won’t be a problem for you, but you will be surprised at how difficult it is to refuse the things that are tempting you. You must stick to every aspect of your budget, and this means not going overboard on the money that you’ve set aside for yourself.

If the option comes up to go on a road trip, or to an expensive restaurant, you should tell yourself that you can only do it if there’s sufficient money in the leisure portion of your budget. It can get frustrating, but doing this will also teach you to enjoy things more and not to make impulse decisions on how you spend your free time. This doesn’t exclusively apply to fun things either. Restrain yourself from contributing to fundraisers or helping out a friend who’s struggling with money unless you’ve got it to spare.

You might sometimes feel like you’re being pressured into doing things, but endure this feeling and refuse. Otherwise you’re financial state will suffer.

Conclusion

The most important thing that you should take away from all of this, is that skills like these five are best learned when you are young. Take your finances seriously from the second you start earning money, and you will reap the rewards as you progress through your life.

Follow The Prepper Journal on Facebook!

The post Physical Security Requires Fiscal Security appeared first on The Prepper Journal.

from The Prepper Journal

Don't forget to visit the store and pick up some gear at The COR Outfitters. How prepared are you for emergencies?

#SurvivalFirestarter #SurvivalBugOutBackpack #PrepperSurvivalPack #SHTFGear #SHTFBag

No comments:

Post a Comment